In 2024, global debt has surged to unprecedented levels, reaching $312 trillion, primarily driven by borrowing in major economies like the United States and China. Despite this rise, governments in both advanced and emerging markets appear reluctant to address the looming debt crisis.

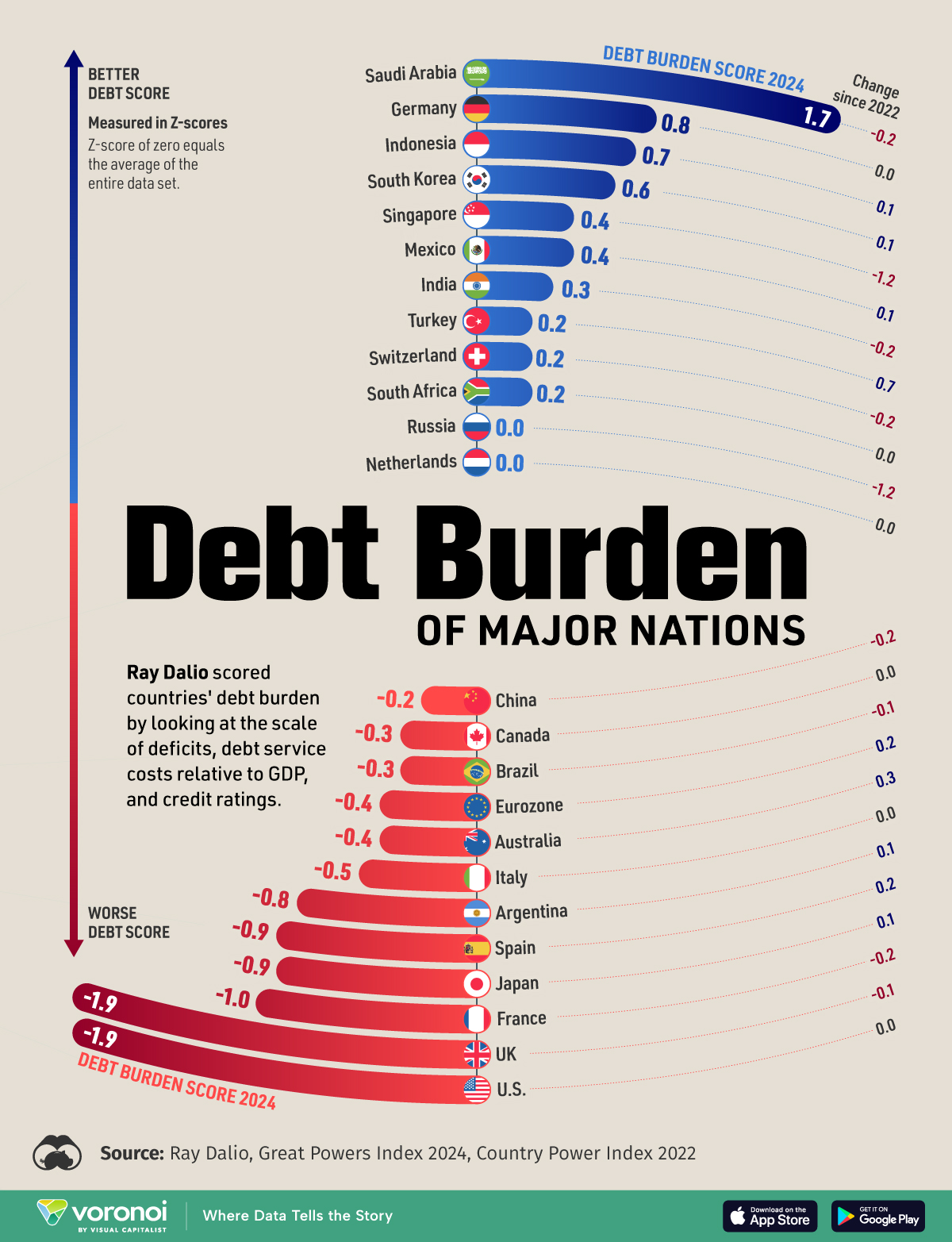

Projections suggest that global government borrowing could increase from the current $92 trillion to an alarming $440 trillion by 2050.This article highlights the debt burden of the world’s leading economies, drawing from Ray Dalio’s “Great Powers Index 2024.” Dalio’s analysis considers various factors, including debt-to-assets ratios, surpluses and deficits, and credit ratings, all combined into a comprehensive debt burden score.Global Leaders Struggle with Debt. Among 24 major global economies, the rankings show that G7 countries, including the U.S. and the UK, are experiencing some of the highest debt burdens. Both nations are grappling with demographic challenges such as aging populations, which are slowing their economic growth prospects.

This, coupled with rising debt-to-GDP ratios, is a major cause for concern. For instance, the UK has projected its debt-to-GDP ratio could triple by 2070 if current policies remain unchanged.In contrast, Saudi Arabia leads the rankings with a relatively low debt burden score. The nation maintains a public debt-to-GDP ratio of 24%, a stark contrast to the European Union’s average of 82% and the U.S.’s 132% as of 2023. While Saudi Arabia’s economy has historically relied on oil, it is now diversifying into other sectors, including sports and tourism, to secure long-term growth.**Debt Rankings: Who’s Faring the Best and Worst?**

According to Dalio’s index, Saudi Arabia ranks highest with a debt burden score of 1.7, while other major economies like Germany(0.8), Indonesia(0.7), and South Korea(0.6) follow suit with relatively strong fiscal positions. These nations, to varying degrees, have shown resilience against the global debt surge, benefiting from diversified economies or disciplined fiscal policies.At the lower end of the spectrum, G7 nations such as the U.S. and UK face mounting debt burdens, exacerbated by slower economic growth and higher debt servicing costs. China, on the other hand, faces challenges within its local government debt, heavily reliant on a weakening property market. In 2020, property income accounted for over 40% of local government revenues, but the sector’s decline has placed enormous pressure on fiscal stability.

+ There are no comments

Add yours